Can you create a PayPal account from Pakistan in 2024? The answer to this question is more complex than yes or no. Let us explore PayPal, its benefits, and how Pakistanis can complete online transactions through it. Sit back and relax as we answer all your questions!

What is PayPal?

The world has become a digital sphere, with businesses communicating worldwide regardless of distance, region, or time zone. Many people have faced scams, deductions, and even no payments due to insecure banking channels or banks’ inability to make cross-country payments.

Then, in December 1998, PayPal was introduced and simply took the world with a bang!

PayPal was created as a revolutionary solution to smoother online transactions. Its primary purpose was to make online payments more effortless and secure for everyone.

PayPal allows people and businesses to send and receive money by linking their bank accounts, credit cards, or debit cards with their PayPal accounts.

Personal or business payments, e-commerce transactions, and freelance payments can run smoothly through PayPal.

This blog will explore how can Pakistanis create a PayPal account in 2024, including its benefits, alternatives, and more.

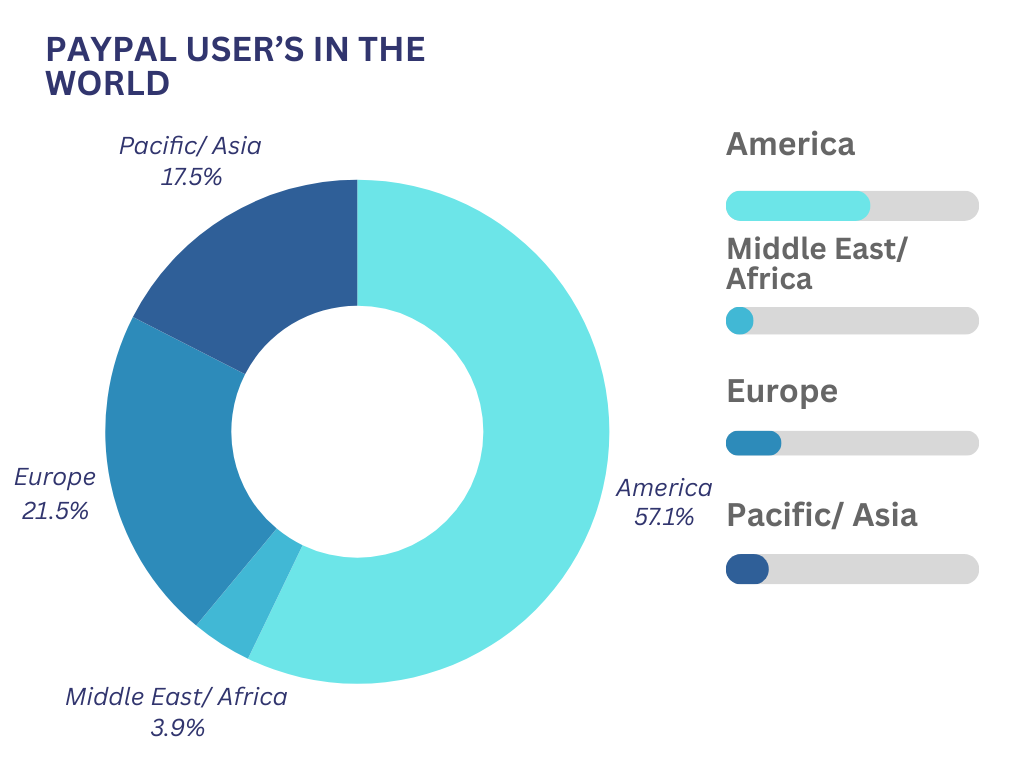

Here is an approximate idea of how PayPal is used all over the world:

Why is PayPal beneficial for you?

According to Tribune, there are approximately 300 million freelancers in Pakistan, and web development and graphic design are the most popular. Per the IT Ministry of Pakistan, “The Pakistani freelance market has generated over $500 million in the last year.”(Source: Mohsin Zox). For a vast market, a secure channel is needed for timely transactions. Here is where PayPal comes in:

PayPal gives you many benefits, some of them are:

- Secure Transactions:

Online payment platforms prioritise security to protect users’ financial information, using advanced encryption technologies to ensure all transactions are safe from scams.

- Easy International Payments:

With the ability to send and receive payments across borders, users can effortlessly transact with friends, family, or businesses anywhere in the world. In conclusion, PayPal has made cross-country transactions easy.

- Acceptance of third-party applications:

PayPal is not a rigid platform. It will allow third-party applications like Payoneer to link banks and other online channels through their PayPal account from Pakistan in 2024.

- User-friendly interface:

Most payment platforms are designed with the user in mind. This provides intuitive navigation and features that improve the user experience, which makes it easy for anyone to use, regardless of their tech knowledge.

What is PayPal’s transaction fee?

Paypal does not have a one fee fits all policy. The transaction fee may vary for different amounts being sent or transferred.

Here is a concise

| Transaction Type | Fee |

| Domestic Transactions | 2.9% + USD 0.30 per transaction |

| International Transactions | 4.4% + fixed fee based on currency |

| International Personal Payments | 5% of transaction amount (min $0.99, max $4.99) |

| Micropayments | 5% + USD 0.05 per transaction |

| Non-profit Discount Rate | 2.2% + USD 0.30 per transaction |

| Cross-Border Fee | 1.5% of transaction amount |

| Currency Conversion | 3.5-4.5% above the base exchange rate |

Source: Lili

For a more accurate fee structure, visit PayPal’s official website and if learn about “How to Create an HBL Konnect Account? | Konnect by HBL“

Step-By-Step Guide to Make a PayPal Account from Pakistan in 2024

Here is a step-by-step guide how can Pakistanis create a PayPal account in 2024?

Visit the PayPal Website

The first step is to visit PayPal’s official website. Click on the “Signup” button located at the top right corner of the homepage.

Choose Your Account Type

Select the type of account you want to create. The options are as follows: Personal Account, Business Account. A personal account is for individuals to use for international payments, e.g., freelance payments, etc., while a business account accepts payments for goods and services.

Enter your information

Fill in all the required details, i.e., name, email address, and a secure password. Make sure that your password meets the security requirements of the platform (a blend of symbols, lowercase, and uppercase letters)

Add your Address and Phone Number

Provide your residential address and a valid phone number. PayPal will then send a verification code on the set number to confirm the validity of the information added.

Link Your Bank Account or Credit/ Debit Card

The next step is to link your bank account or credit/debit card with your PayPal account. Provide all the required information and ensure that all information is valid.

Verify your Email

After completing all processes, PayPal will send you a verification link to your email address. Click on that email address to validate your email address with PayPal’s official site.

Confirm Your Identity

You might be asked to confirm your identity depending on your location and the information provided. Follow the prompts to complete this process, including submitting additional documents.

Review and Accept PayPal’s Terms and Conditions

Read through PayPal’s user agreement and privacy policy. By accepting the terms, you agree to use the service accordingly.

Set Up Security Measures

Configure additional security features, such as two-factor authentication, to enhance the security of your account.

Start Transacting

Once your account is set up and verified, you can send and receive money. Add contacts and begin using PayPal for your transactions.

Challenges in Pakistan

Unfortunately, PayPal does not offer its services directly to users in Pakistan. This limits access to a popular payment solution that many people use worldwide. Setting up an account on different payment platforms can be challenging. There are many verification steps and document requirements that can discourage new users.

Many local banks and payment services have limits on international transactions. This makes it hard for users in Pakistan to send or receive money from abroad. Users may need help to link their local bank accounts to international payment platforms. This can prevent them from entirely using these services.

How can you access PayPal’s services from Pakistan in 2024?

As of 2024, PayPal’s services are not available directly in Pakistan. But there are some options you can explore to create a PayPal account from Pakistan in 2024:

Use a VPN: Some people use it to create a PayPal account by masking their location.

Open an Account Abroad: If possible, open an account using a trusted friend’s address in another country and enter that information into PayPal’s database.

Explore Alternatives: Look for local payment services that offer similar features for international transactions. Some of those platforms are Payoneer, Skrill, etc.

Payoneer: This platform lets businesses and professionals send and receive payments globally. It offers competitive exchange rates and a prepaid Mastercard for easy access to funds.

Skrill: This e-wallet service allows users to make online payments securely. It also offers features like cryptocurrency, trading, and loyalty programs for transaction rewards.

Stay Updated: Follow news about PayPal’s services in Pakistan, as changes could happen.

To sum it all up!

While setting up a PayPal account in Pakistan involves navigating many challenges, the potential benefits for global transactions make it worthwhile. By following our step-by-step guide and exploring the alternate options listed above, you can find a solution that meets your needs.

If any problems arise while making a PayPal account from Pakistan in 2024 or exploring alternate options, you can contact Abex Technologies, and we’ll be sure to answer all your queries ASAP!

FAQs:

A: Directly creating a PayPal account from Pakistan is not possible. However, alternatives like using a VPN or opening an account abroad can be explored.

A: PayPal offers secure transactions, easy international payments, acceptance of third-party applications like Payoneer, and a user-friendly interface.

A: You can use a VPN, open an account using a trusted friend’s address abroad, or explore local alternatives like Payoneer and Skrill.

A: PayPal fees vary: Domestic transactions are 2.9% + $0.30, international transactions are 4.4% + a fixed fee, and other fees apply based on the transaction type.

A: Alternatives include Payoneer, which offers global payment services, and Skrill, which provides secure online payments and additional features like cryptocurrency trading.

A: Visit PayPal’s website, sign up using a VPN to mask your location, choose your account type, enter your information, link your bank account or card, verify your email, confirm your identity, and accept the terms and conditions.